Paycheck tax calculator georgia

Georgia State Tax Quick Facts. Your average tax rate is 1198 and your marginal tax rate is.

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Georgia State.

. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Georgia residents only. Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking To calculate a. This calculator can estimate the tax due when you buy a vehicle.

To use our Georgia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. The first thing you need to know about the Georgia paycheck calculator is your hourly and salary income as well as the various pay frequencies. On the other hand if you make more than 200000 annually you will pay.

State Date State Georgia. Content updated daily for ga payroll calculator. Georgia Georgia Hourly Paycheck Calculator Results Below are your Georgia salary paycheck results.

Figure out your filing status. As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. Get the Paycheck Tools your competitors are already using - Start Now.

Georgia does not tax Social Security retirement benefits and provides a maximum deduction of 65000 per person on all types of retirement income for anyone 65 or older. Work out your adjusted gross income. The Georgia bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Luckily our Georgia payroll calculator eliminates all the extra clutter associated with calculating payroll so your administrative duties wont be quite as dull. After a few seconds you will be provided with a full breakdown. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Ad Choose Your Paycheck Tools from the Premier Resource for Businesses. Georgia Paycheck Calculator Find out how much your take home pay is after income tax so you can have a better idea of what to expect when planning your budget 8 Ratings Optional Criteria. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Georgia residents only.

The results are broken up into three sections. New residents to Georgia pay TAVT at a rate of 3 New. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

It is not a substitute for the advice of. Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. All you have to do.

Paycheck Results is your gross pay and. It is not a substitute for the advice of. 087 average effective rate.

All Services Backed by Tax Guarantee. Switch to Georgia salary calculator. Georgia Income Tax Calculator 2021.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. 287 cents per gallon of regular. This Georgia hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Ad This is the newest place to search delivering top results from across the web. If you want to determine your. Calculating your Georgia state income tax is similar to the steps we listed on our Federal paycheck calculator.

If you make 70000 a year living in the region of Georgia USA you will be taxed 11993. Non-titled vehicles and trailers are exempt from TAVT but are subject to annual ad valorem tax. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Georgia.

Paycheck Manager provides a FREE Payroll Tax Calculator with a no hassle policy.

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Paycheck Calculator Take Home Pay Calculator

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Georgia Paycheck Calculator Smartasset

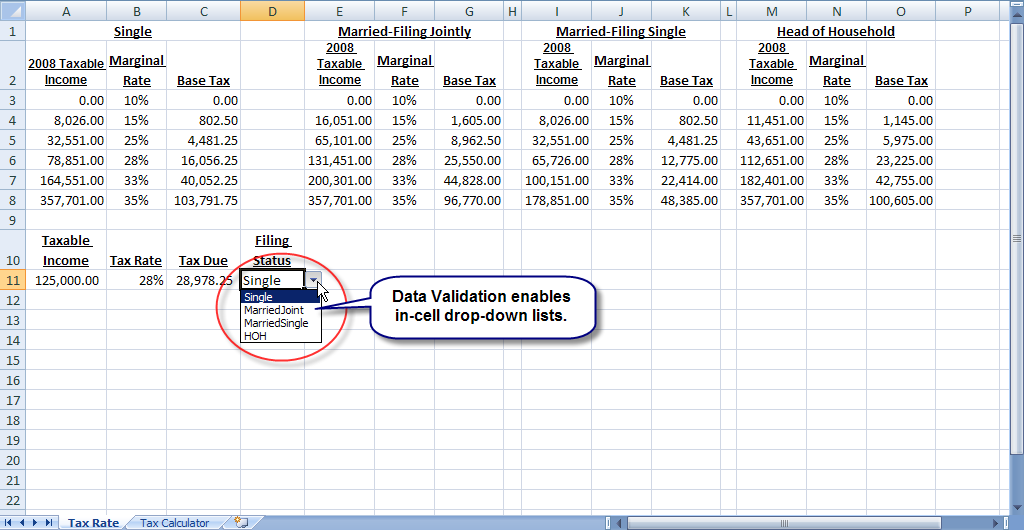

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

Georgia Sales Reverse Sales Tax Calculator Dremploye

Paycheck Calculator Take Home Pay Calculator

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Income Tax Calculator Estimate Your Refund In Seconds For Free

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

How To Calculate Payroll Taxes Methods Examples More

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Estimate Taxes For 2020 Cheap Sale 53 Off Www Ingeniovirtual Com

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc